- Home

- War in the Middle East

- Strait of Hormuz: Is Iran Ready to Gamble with Global Energy Stability?

©This is Beirut

As the Middle East flares up amid mounting tensions between Iran and Israel, one urgent question dominates global attention: Is Tehran ready to close the Strait of Hormuz, a crucial lifeline for the world’s energy supply?

On Friday night, Emmanuel Macron sounded a stark warning. In a statement, the French president cautioned, “We must brace ourselves for the economic repercussions of the Israel-Iran conflict.”

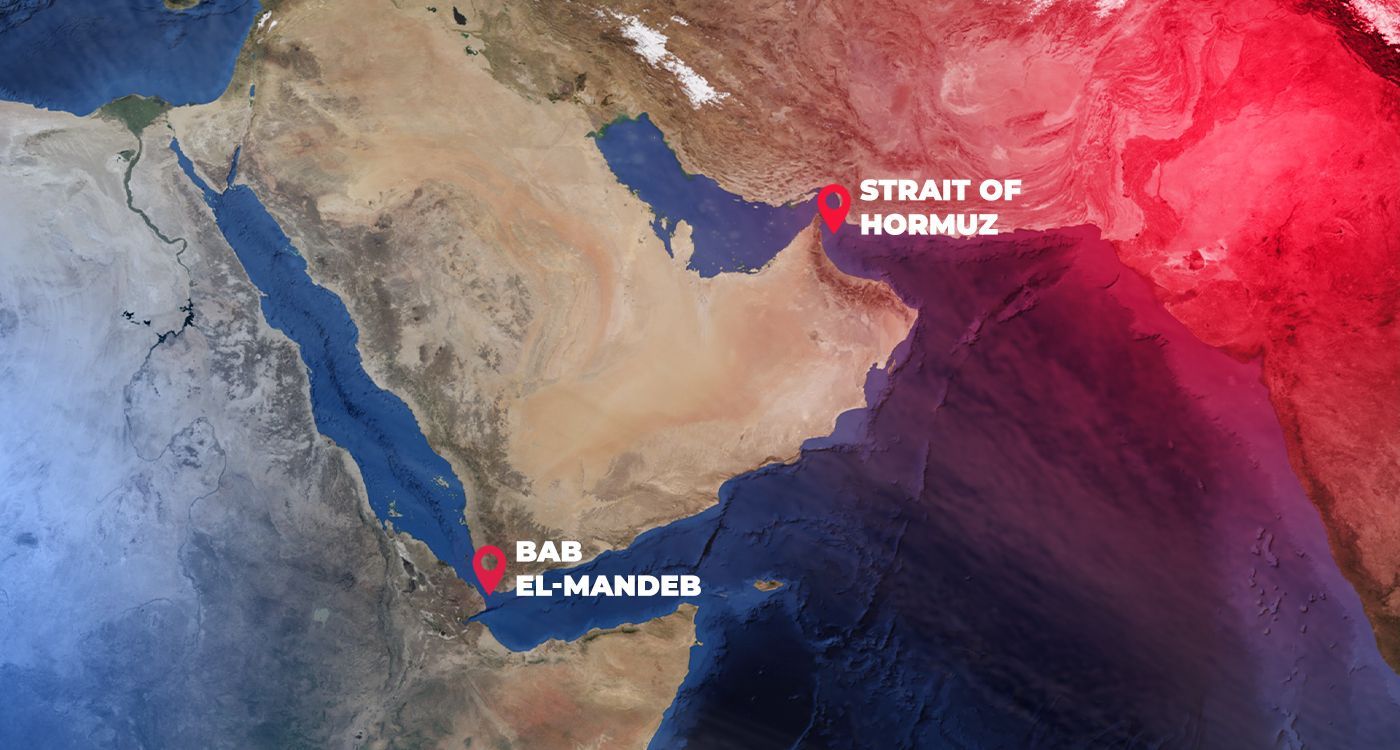

He explicitly named the Strait of Hormuz and alluded to other threatened trade routes amid rising regional tensions. This warning carries significant weight, as this strategic maritime passage—through which 26% of the world’s oil and a third of its liquefied natural gas transit—has become a major geopolitical lever in Iran’s hands.

A Sense of Déjà Vu: Heading Toward a New Oil Shock?

If the strait is blocked, analysts warn of a worst-case scenario straight out of the 1970s. Investment bank JP Morgan projects oil prices could spike to $130 per barrel.

The parallel is clear: in 1973, after the Yom Kippur War, Arab OPEC members imposed an oil embargo on Israel’s allies, sending crude prices soaring fourfold and triggering a global economic crisis.

A Risky Yet Possible Move

For Iran, playing the Strait card would be a desperate move. Still, the warnings are growing louder. Tehran’s threats of “severe and deterrent retaliation” in response to Israeli strikes raise serious concerns about the safety of maritime traffic.

While Iran doesn’t have full military control of the strait, its position just north of territorial waters allows it to closely monitor vessels and maintain significant interception capabilities in the event of conflict.

Experts agree on one thing: closing the Strait of Hormuz would trigger a major energy shock and open the door to a direct confrontation with the United States, which is determined to keep oil flowing freely. It’s a line Tehran remains hesitant to cross.

A Market Under Strain

As long as maritime routes stay open, Gulf countries can offset any potential drop in Iranian supply. But any incident—tanker attacks, rising tensions in the Red Sea or Houthi actions—could send insurance premiums soaring, drive up logistics costs and spark a fresh wave of inflation.

Today, the Strait of Hormuz acts as a barometer for a regional conflict with global consequences. A single spark could shift the world’s energy balance.

Read more

Comments