An article written by an Internet user called “Zouzou Cash” (@ZouzouCash) has been circulating for a few days, proposing a critical approach to the IMF that is important to take into consideration.

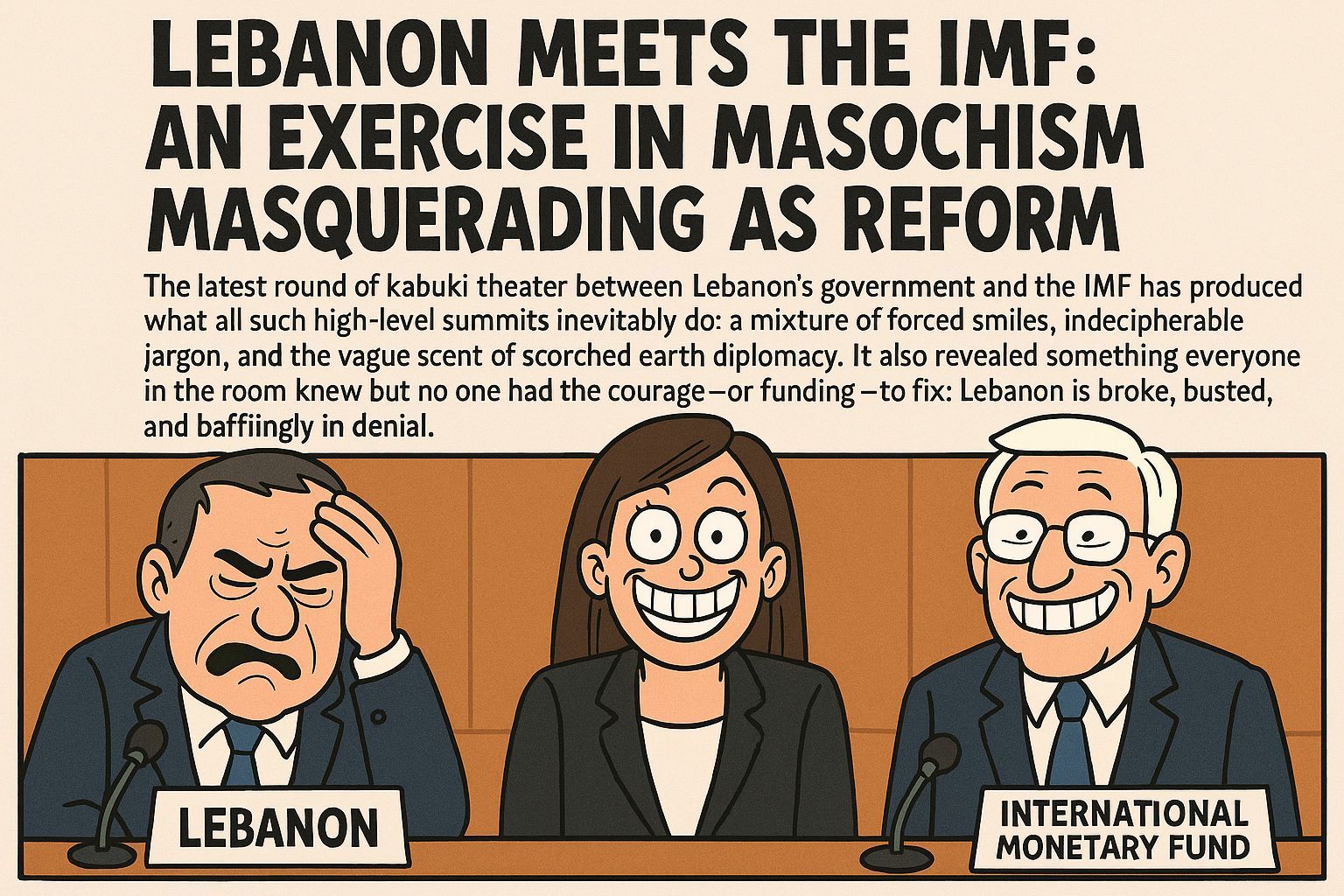

The latest round of kabuki theater between Lebanon’s government and the IMF has produced what all such high-level summits inevitably do: a mixture of forced smiles, indecipherable jargon, and the vague scent of scorched-earth diplomacy. It also revealed something everyone in the room knew but no one had the courage—or funding—to fix: Lebanon is broke, busted, and bafflingly in denial.

The meetings included a wide range of participants: ministers, central bankers, technocrats, pseudo-technocrats, IMF reps, and the usual crowd of expats who speak five languages but can’t seem to find a working ATM. Some left the sessions shocked, others vaguely titillated—especially the crowd who considers every foreigner an oracle, whether it’s an IMF official with a spreadsheet of austerity measures or a lost German tourist asking for directions to Byblos.

So what is the IMF doing in Lebanon, that small strip of Mediterranean chaos with more failed governments than working elevators? Well, since the country managed to torch its bridges with the Gulf (oil-rich and now Lebanon-averse), antagonize the Americans (never a good idea), and tie itself up with pro-Iranian policy since roughly the invention of electricity, Lebanon finds itself cast out into the geopolitical wilderness. The Gulf has closed the tap, the U.S. has shut the door, and only France remains, clucking around like a confused nanny trying to discipline a pyromaniac toddler.

Enter the IMF: the global lender of last resort and first proponent of national detox. When you’re too bankrupt for Goldman Sachs and too delusional for World Bank, the IMF arrives—armed with algorithms, an addiction to conditionality, and the charm of a root canal.

The IMF team in Lebanon has become a fixture since 2020. Their cast rotates, but the script remains unchanged. At the center of it all is Ernesto, the ever-smiling head of mission who listens patiently, answers nothing, and repeats IMF gospel with the enthusiasm of a Scientology recruiter: “debt sustainability,” “fiscal consolidation,” “restructuring,” blah blah—insert your favorite technocratic euphemism for economic demolition.

Then there’s Frederico, Lebanon’s resident IMF rep, who has made admirable progress in becoming a connoisseur of Lebanese mezze and rooftop parties, though less so in understanding Lebanese politics or its banking system. Finally, there’s Jaime, the new “banking expert,” whose main hobby seems to be mentally liquidating banks before lunch and telling them how lucky they are to get even a PowerPoint presentation from him.

Ironically, the Lebanese IMF staff are the only ones in the group who seem to have read a history book or taken a look at a balance sheet—though no one really lets them talk unless it’s to find their way to the next meeting location.

Now, what’s the big IMF plan? Oh, it’s simple: save the state, destroy the Central Bank, annihilate the commercial banks, and vaporize depositors. Voilà. Think of it as Marie Antoinette-style economics, but instead of cake, they’re serving you sovereign defaults and deposit haircuts.

Under the IMF’s sacred twin doctrines—Debt Sustainability and Hierarchy of Claims—the path to redemption is a one-way street paved with depositor tears and missing pension funds.

Debt Sustainability means you generously offer bondholders 20 cents on the dollar—over a few decades, if they’re lucky—and you politely ignore the $16.5 billion the Lebanese State owes the Central Bank, because apparently when a state owes money to its own central bank, it’s like owing money to your left hand.

Hierarchy of Claims is the fun part: equity holders in banks? Gone. Bondholders? Sorry. Depositors? Here’s a lollipop and a 90% loss. And who pays for this entire mess? Why, the Central Bank, of course—because nothing says sound monetary policy like torching the institution responsible for monetary policy. Their reserves ($10 billion) and their gold ($30 billion) are apparently sitting there like a piñata waiting for the next round of policy reform.

And the government? Oh, they walk away untouched. No haircut, no asset sales, no meaningful reform. The same government that created the mess is now expected to enforce the cleanup with surgical precision and moral authority. It’s like asking the arsonist to lead the fire brigade.

Of course, behind the curtain are the usual suspects—the Quintet of Nations—urging the IMF on, hoping the pain will force Lebanon to do what they could never convince it to do diplomatically: disarm Hezbollah, fight corruption, and sign a peace treaty or two before breakfast.

So here we are. The IMF has a plan that’s as unworkable as it is unpopular. It won’t pass in Parliament—this one or the next—and no Lebanese government (short of a Martian technocracy) will ever implement it. The Central Bank knows it, the banks know it, the depositors know it, and even Ernesto Rigo might suspect it when no one’s looking.

The real tragedy? This isn’t an evil plan. It’s just a lazy one. A generic, out-of-the-box, cookie-cutter model being dropped on a very non-cookie-cutter crisis. Lebanon needs reform, yes. But IMF austerity on steroids? That’s not reform. That’s euthanasia.

Comments