The massive surtax on alcoholic beverages proposed in the 2025 budget has sparked outrage among hotel and restaurant owners, who fear it will negatively impact consumption and, consequently, their businesses and the overall tourism sector.

The tax rates have been multiplied by 225 and up to 750 times, which is utterly staggering. This tax hike is widely regarded as unfair and even shocking to the Lebanese. Firstly, because it is not part of an economic policy based on a clear and logical vision, and merely reflects a desire to draw quick funds to the Treasury. Secondly, alcohol consumption is not a major concern in the country, and the State is not supposed to regulate it.

Before the 2019 economic crisis, the tourism sector’s direct and indirect financial contributions accounted for 19.1% of GDP. This share fell to 4.9% in 2020 due to the Covid-19 pandemic, dropped further to 2.5% in 2021, and then slightly recovered to 6.6% in 2023, according to data from the World Travel & Tourism Council (WTTC).

Separate Draft Law

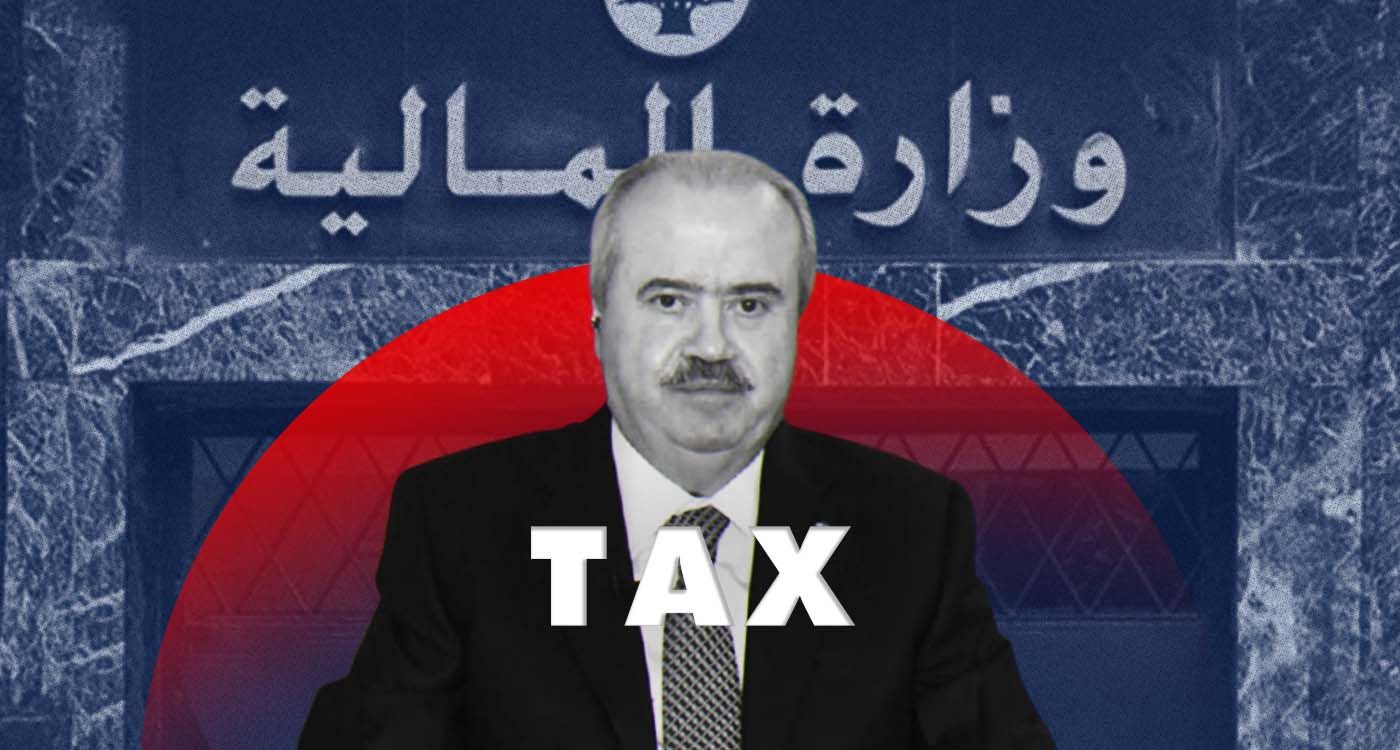

To minimize the social and economic impact of surtaxes on certain products and services, Prime Minister Nawaf Salam’s cabinet has tasked Finance Minister Yassine Jaber with reviewing the proposed tax rates. The new rates will be outlined in a separate draft law.

On Thursday, the Cabinet adopted the 2025 budget draft via decree, opting for the least restrictive approach. Salam justified the move by emphasizing the need to avoid prolonged parliamentary debates and to prevent reliance on Treasury advances, which are mandated under the provisional budget framework, particularly due to the financial strain caused by the conflict between Israel and Hezbollah.

2025 Budget

Ibrahim Kanaan, head of the Parliamentary Finance and Budget Committee, has strongly criticized the proposed surtaxes, which have increased by 100 to 400 times. He accused the former government of exploiting the system’s dysfunctions to cover part of the budget deficit at the expense of citizens, even though the surtaxes do not affect essential goods.

In response, Finance Minister Yassin Jaber has pledged, under Article 118 of the Public Accounting Law, to improve revenue through various reforms. He highlighted efforts to tackle customs fraud, tax evasion, VAT fraud and the digitization of cadastral and Ministry of Finance services.

In short, Prime Minister Nawaf Salam has called on the Lebanese people to hold the government accountable for the 2026 budget, which he will oversee.

Comments