- Home

- Middle East

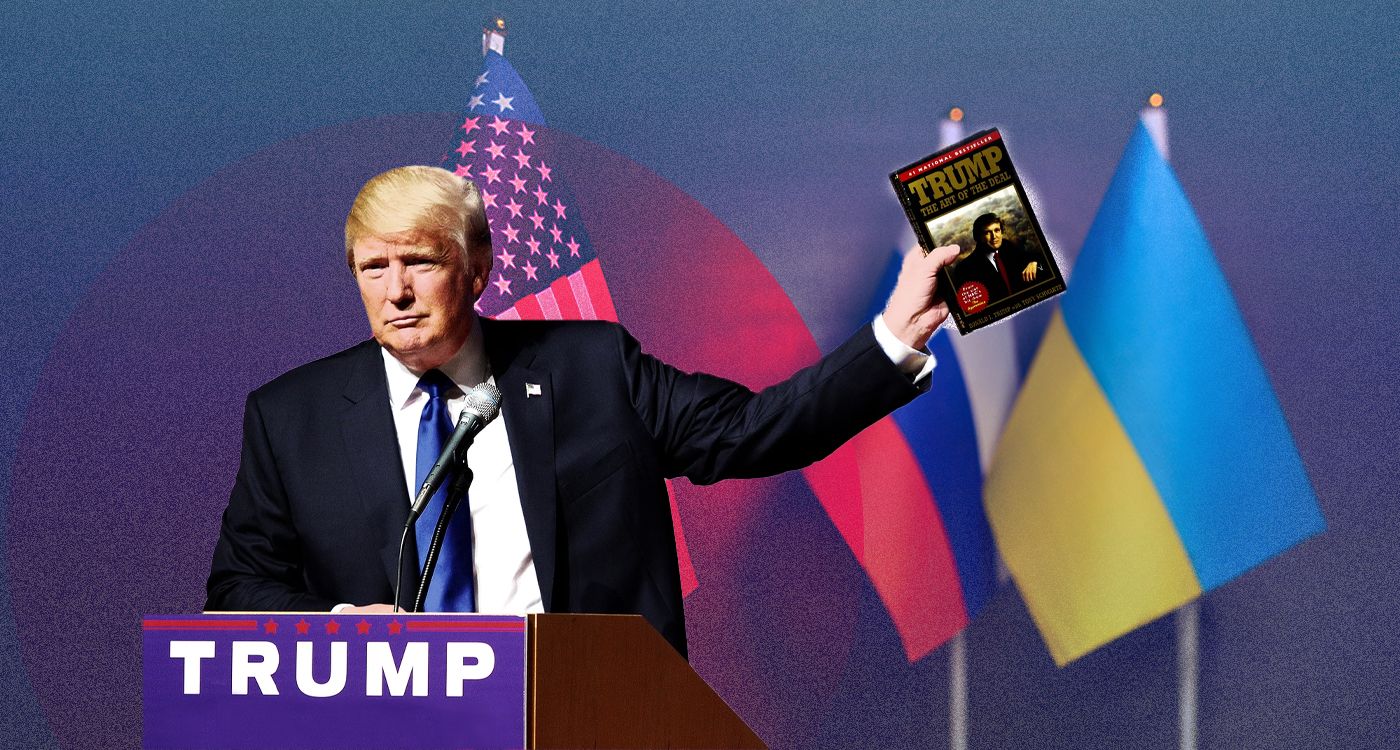

- Trump’s Art of the Deal: Ukraine, Russia, and the $500 Billion Power Play

©This is Beirut

If you think diplomacy is about treaties and handshakes, you haven’t been paying attention. In the world of Donald J. Trump, geopolitics is just another business deal. And in his latest playbook for Ukraine, he’s offering a trade deal that sounds more like a corporate takeover than a peace agreement.

Here’s the pitch: Ukraine, battered by two years of war, gets a massive $500 billion reconstruction fund. In exchange, Trump’s America takes a 50% cut of Ukraine’s natural resources, its rare earth minerals, ports, and infrastructure. The agreement, as reported, would be governed by US law and give Washington priority over Ukraine’s most valuable exports.

It’s a deal so aggressive that some are comparing it to post-WWII reparations imposed on Germany and Japan. Except in this case, Ukraine isn’t a defeated enemy, it’s an ally that fought a war with American support. And yet, under this proposed agreement, Kyiv would effectively become an economic vassal state to the United States.

But Trump’s plan doesn’t stop at restructuring Ukraine’s economy. It also offers Russia a prize it has long sought: Ukraine’s NATO aspirations would be officially off the table. That’s right, Trump would trade away one of Kyiv’s most sacred geopolitical goals, effectively giving Vladimir Putin a major victory. In return, Russia would agree to transfer $300 billion of its frozen assets (currently held in Belgium) to Ukraine.

Let’s break this down like a Trump business deal:

Ukraine loses half of its revenue from natural resources, locks itself into a US-controlled investment fund, and agrees to remain outside NATO indefinitely. But it gains $300 billion in frozen Russian assets and secures funding for reconstruction.

Russia loses access to its frozen billions but cements its hold over occupied Ukrainian territories and eliminates the NATO threat.

The US wins big. American contractors get a $500 billion infrastructure bonanza, and Washington locks up Ukraine’s rare earth minerals, valued at nearly $6 trillion. Europe? Well, Europe gets nothing. Shut out of the deal, sidelined from peace talks, and left wondering if its Atlantic partner is now negotiating over its head. If this all sounds too audacious to be real, consider Trump’s track record. This is the same man who floated the idea of buying Greenland, waged a trade war with China, and rewrote NAFTA. He doesn’t see countries, he sees assets. For Trump, this isn’t about democracy or sovereignty. It’s about leverage. He has long believed that Europe free-rides on American military power, and this deal makes clear who's in charge. Ukraine would become economically bound to the US, while NATO, especially the EU, would have little say in its future. It’s a classic Trump move: shift power away from multilateral institutions, strike a direct deal that benefits US interests first, and frame himself as a peacemaker in the process. He knows that many Americans are weary of endless funding for Ukraine. This deal allows him to say: “Look, I got Ukraine the money it needs but I made sure America got a return on investment.”

And then, there’s the wildcard: the U.K.: While Washington and Moscow maneuver, Britain is reportedly preparing to put boots on the ground in Ukraine—an indication that London sees this proposed peace as more of a surrender. If British troops are deployed, the war may not just continue, it may escalate beyond Ukraine’s borders.

Trump’s deal, then, is less about ending the war and more about restructuring the conflict. By sidelining Europe, securing US financial dominance over Ukraine, and giving Russia a strategic win, he is laying the foundation for a new order, one where America dictates the terms, and everyone else scrambles to keep up.

Whether this plan will ever be implemented remains to be seen. But one thing is clear: Trump’s vision for Ukraine is less about peace and more about profit. It’s geopolitics, Trump-style, where the world isn’t divided into winners and losers, but buyers and sellers.

Read more

Comments