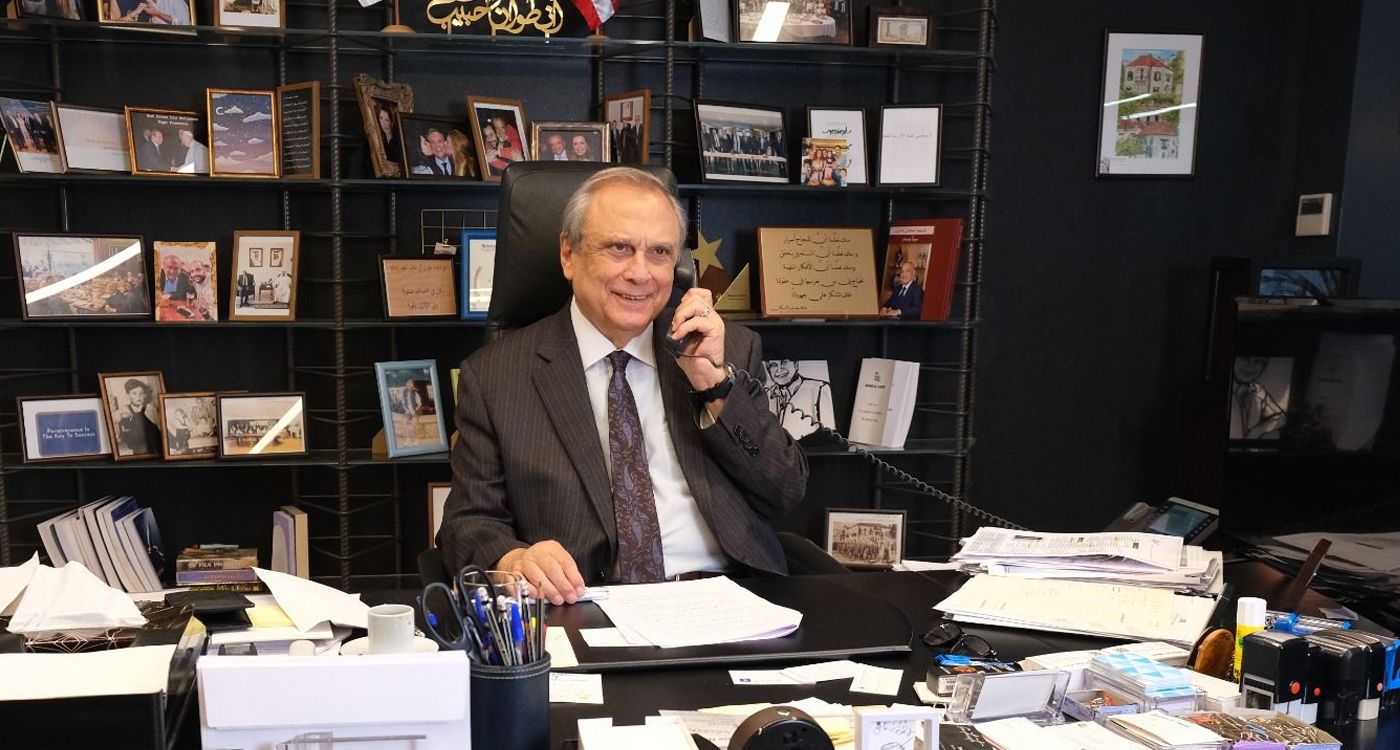

As Lebanon faces turmoil, Antoine Habib, Chairman and General Manager at Banque de l'Habitat (BDH), speaks about construction, reconstruction, and renovation.

In an interview with This is Beirut, Antoine Habib, Chairman and General Manager of Banque de l'Habitat (BDH), shared that despite Lebanon's challenging situation, the bank has resumed issuing loans, with many already disbursed. These loans, aimed at low- and middle-income individuals, cover the purchase of apartments, home renovations, land development, and the installation of solar panels.

To qualify for the loan, several key conditions must be met: the apartment size must not exceed 150 square meters; the applicant must be Lebanese, have no prior subsidized loans, and own no land in Lebanon; 20% of the purchase value must be secured; and the applicant’s monthly salary must be between $1,200 and $1,500.

The loan amounts are $50,000 for middle-income individuals and $40,000 for low-income individuals. Habib emphasized that loans can also be granted to individuals with special needs. He highlighted that all applications are processed online to eliminate interference, political pressure, and favoritism.

Habib disclosed that 25,000 individuals visited the site. Of these, 6,000 began the application process but did not complete it, while 3,000 submitted full applications. These applications are distributed across the six BDH branches as follows: 2,537 for purchasing, 289 for construction, 246 for renovations in dollars, and 4 for renovations in Lebanese pounds, as of October 10.

Most applications came from the Beirut branches for purchases outside the capital, where prices are more affordable. However, of the 3,000 applications that met the requirements, only 800 found properties to purchase. Habib emphasized that a deed of ownership is essential.

What About the Financing and Repayment of These Loans?

It's important to highlight that, thanks to a loan from the Arab Fund for Economic and Social Development to BDH, Lebanese citizens can once again access subsidized housing loans. The Fund has approved a five-year loan for the financial institution totaling 50 million Kuwaiti dinars, roughly $165 million. Each year, BDH will receive 10 million dinars—approximately $34 million—distributed in two semiannual payments of 5 million. The first payment of $17 million was received at the beginning of September.

The Central Bank of Lebanon (CBL) will act as an intermediary to transfer the funds to the account that BDH has opened at the National Bank of Kuwait in Bahrain. Transfers to and from this account will be managed by the borrowers. Habib explained that the adoption of this cross-border account mechanism is linked to the events that followed the collapse of the Lebanese pound and to the Lebanese who repaid their dollar loans in Lebanese pounds. “This way, repayment in dollars will be guaranteed,” he noted, emphasizing that “the source of funding is in dollars.”

In this context, it's essential to note that BDH has received three subsidized loans from the Arab Fund: $51 million in 1995, $110 million in 2012, and $165 million in 2019. However, due to the financial crisis in Lebanon, these funds were not utilized for five years. According to the law, they are canceled for non-use. In 2022, Habib began discussions with the Fund to revive the loan. However, negotiations were challenging due to Lebanon's default. Nevertheless, after a detailed report demonstrated that BDH continued to repay the principal and interest, the Fund responded positively to renewing the loan and unlocking the funds.

Financing Diversification

Habib also revealed that his institution is in discussions with the Abu Dhabi Development Fund and the Kuwait Fund to secure additional loans, which would increase the individual loan amount from $50,000 to $100,000. To diversify funding sources, he revisited a law regarding deposit certificates required by the Ministry of Labor for hiring foreign workers. The amount was raised to 20 million pounds per certificate, enabling financing for renovation loans in Lebanese pounds.

He highlighted a law from May 4, 1968, amended by Parliament in 1999, which mandates insurance companies to issue guarantees through BDH for the Ministry of Economy. A memorandum of understanding has been signed with the Insurance Brokers Syndicate, and talks are ongoing with the Insurance Syndicate for a similar agreement.

Additionally, he is working on creating a fund financed by insurance companies, featuring interest-bearing deposits, to provide housing loans to low-income individuals. In practice, insurance companies will deposit their funds at BDH, with the assurance that BDH will secure the necessary insurance for the loans.

These funds will also support the implementation of a wastewater treatment project and the installation of a water treatment plant, with technical assistance from USAID.

Finally, Habib, maintaining an optimistic outlook for the future, confirmed that preliminary discussions have started with BDH to provide subsidized housing loans sourced from funds secured by Lebanon for reconstruction once the current conflict comes to an end.

Comments